Let’s start by saying you have a business tax liability with the IRS. After you have begun making your current deposits and filed all of your back tax returns, it becomes time to focus on the debt.

Let’s start by saying you have a business tax liability with the IRS. After you have begun making your current deposits and filed all of your back tax returns, it becomes time to focus on the debt.

Now, let’s take a look at how the IRS views this exact situation:

- A: Do you have assets (liquid or illiquid) to pay the debt? In other words, do you have the cash or something that you can sell for cash to write the IRS a check? Probably not, but that’s the first thing it will look at.

- B: Do you have the cash flow to pay back the debt over time? What does the businesses’ cash flow look like? This is what the IRS will evaluate to determine if you can afford an Installment Agreement (Payment Plan).

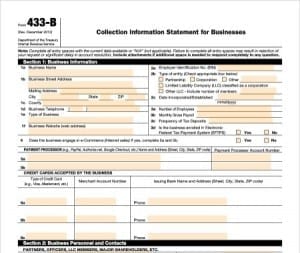

You may be curious as to how the IRS knows these things about your business. For starters, it will ask you for a financial statement and require that the statement be submitted on one of its standard forms. In this particular case, Form 433 B: Collection Information Statement for Businesses, would be requested. This form is what the IRS will use to determine how much and how fast you can pay it back.

It’s very important to be accurate when filling out this form because it will back up any statements you make to the IRS about how much you can afford to pay. If your financial statement overstates your cash flow and / or assets, you guessed it, the IRS will ask you to pay back more than you can actually afford. If you understate your cash flow and / or assets, the IRS will think that your business is insolvent.

The bottom line: don’t view the task of filling out one of these forms as something that is merely a formality and fail to put the proper attention towards this essential task. Completing these forms without mistakes is a very important part of the negotiating process.